are nursing home expenses tax deductible in canada

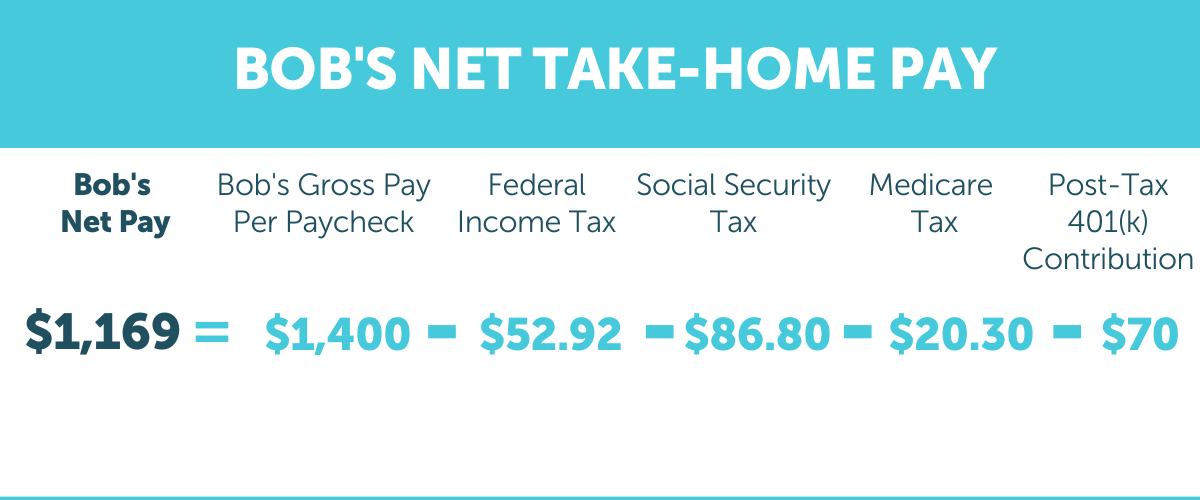

But Jul 27 2022 3 min read. Under the formula the lowest tax rate percentage 15 for years after 2006 is multiplied by the total of two calculated amountsThe first calculated amount relates to medical expenses paid in respect of the.

Can You Claim A Tax Deduction For Assisted Living The Arbors

We remained focused on employees and customers during this second year of the pandemic and.

. In computing unrelated business income tax an exempt social club may claim the credit under Code section 45B for the portion of employer social security taxes paid with respect to employee tips received from both members and nonmembers. 1 online tax filing solution for self-employed. Your or your spouses or common-law partners.

Health insurance premiums and prescription drugs and nursing care etc. 250 reduction in expenses. 2003 Revenue Ruling 2003-64 PDF.

Meaning of untaxed worldwide earner 5 1 In this section. How to claim medical expenses. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Some types of income are tax exempt but are used to determine the tax rate such as unemployment benefits maternity leave payments and certain. Legal fees paid to authorize treatment for mental illness. Calculating the medical expense tax credit.

Line 33099 You can claim the total eligible medical expenses you or your spouse or common-law partner paid for any of the following persons. Interests dividends and capital gains on stocks are subject to a flat tax of 25 plus a solidarity charge. Long-term care insurance and long-term care expenses.

Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. Are some of these deductible expenses. Francesca is a real estate agent who has a qualifying home office.

However if the resident is chronically ill andin the facility primarily for medical care and the care is being performed according to a certified care plan then the room and board may be considered part of the medical care and the cost may be. There are 5 categories that we place self-education or study expenses in to. In this system also known as single-payer healthcare government-funded healthcare is available to all citizens regardless of their income or employment status.

PART I HEALTH INSURANCE. And the tax-deductible amount will. Your spouse or common-law partner.

Full-Year Report of the Executive Board. Deductibility of self-education expenses incurred by an employee or a person in business. This includes the cost of meals and lodging in the home if a principal reason for being there is to get medical care.

Unfortunately this definition is a bit vague so that once your presenceabsence in Canada starts getting near to 5050 it starts to become questionable as to whether youre ordinarily living in Canada. This article provides a brief overview of the health care systems of the world sorted by continent. Generally only the medical component of assisted living costs is deductible and ordinary living costs like room and board are not.

Assessment has the same meaning as in section 248 1 of the federal Act. Health care systems classification by country Countries with universal government-funded health system. Tax Quarter Payment Due Date Q1.

January - March April 15 2022 Q2. As used in this title unless the context otherwise requires or a different meaning is specifically prescribed health insurance policy means insurance providing benefits due to illness or injury resulting in loss of life loss of earnings or expenses incurred and includes the following types of coverage. As per the recent Income tax laws the health insurance premium paid for a multi-year plan in the lump sum is eligible for a tax deduction under Section 80D.

Lodging expenses while away from home to receive medical care in a hospital or medical facility. For OASGIS purposes residing in Canada is defined as making your home in Canada and ordinarily living in Canada. 11 An individual may claim a medical expense tax credit for the amount determined by the formula in subsection 11821.

Household help for nursing care services. Accelerated organic growth in recurring digital and services revenues combined with a recovery in non-recurring revenue streams produced strong results. This tax credit can also be claimed for your spouse common-law partner and children under 18 years of age.

Exempt from paying income tax for religious. One of these is your medical and dental expenses. You can include in medical expenses the cost of medical care in a nursing home home for the aged or similar institution for yourself your spouse or your dependents.

If all of your self-education or study expenses are from category A then you have to reduce. For more detail about the deductibility of self-education expenses see TR 989 Income tax. Revenue Ruling 2003-49 PDF.

The medical expense tax credit is one of the most overlooked non-refundable tax deductions. According to the IRS the following entertainment related business expenses are still deductible. Be informed and get ahead with.

Lead-based paint removal when a child is diagnosed with lead poisoning. You can claim medical expenses on line 33099 or 33199 of your tax return under Step 5 Federal tax. What types of income are taxable in Germany.

Tax Benefits on Single Premium Medical Insurance Plans. April - May. Since these expenses are an ordinary and necessary part of operating your business they are deductible on your Schedule C and should not be overlooked when you prepare your taxes.

Nancy McKinstry CEO and Chairman of the Executive Board commented. Self-Employed defined as a return with a Schedule CC-EZ tax form. Last year 500 of her home operating costs could be attributed to her office.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. A 50 annual deductible is applied to the total of all eligible health benefit expenses incurred in a benefit year except for prescription drugs and diabetes supplies. These tend to be exorbitant but fortunately for you some expenses are deductible.

Although most Canadians are aware that the medical expense tax credit exists many fail to keep the necessary receipts or running tally of expenses. Questions and answers regarding the reporting and disclosure. Reported total income in relation to an individual for a calendar year means the total of the following amounts each of which is applicable to the individual for an income taxation year of the individual that ends in the immediately preceding.

DogVacay is a network of more than 20000 pet sitters across the US and Canada who offer in-home dog-sitting grooming boarding and walking. Americas 1 tax preparation provider. Wondering what types of income are taxable in Germany.

If youre concerned about how to protect your assets from nursing home costs youre at an advantage if you can plan at least five years out. You can also invest your money and gain higher interest as you will be charged less tax than others. Home nursing care must be provided by a registered nurse or licensed practical nurse who is not a relative of the patient.

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Is In Home Care Tax Deductible Comfort Home Care

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

The Irs And Incontinence Supplies Home Care Delivered

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Medical Expenses Often Overlooked As Tax Deductions Cbc News

Tax Tip Can I Claim Nursing Home Expenses As A Medical Expense 2022 Turbotax Canada Tips

12 Incredible Airbnbs In Colorado Springs Colorado Springs Beautiful Places In America Colorado Vacation

How To Pay For Nursing Homes Assisted Living

What Receipts To Save For Taxes Do S Dont S Wellybox

Is There A Tax Deduction For Memory Care Facility Costs A Place For Mom

It S Tax Time Important Information For Seniors To Consider

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Long Term Care Expenses What Can You Deduct

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Medical Expense Tax Credit Nursing Homes Vs Retirement Homes

Medical Expense Tax Credit Nursing Homes Vs Retirement Homes

What Qualifies As Medical Expenses When Filing Taxes 2022 Turbotax Canada Tips